How to trade SWAVE?

SWAVE is designed as an investment vehicle, to hold high performing crypto assets, setting it apart from other cryptocurrencies. The value of the token is the sum of the value of assets it holds – SWAVE’s Net Asset Value(NAV).

So how do you buy and sell SWAVE? There are 2 ways to trade:

The SWAVE token app lists the most accurate price for the token. On March 7th, 2023, this is what SWAVE’s holdings looked like:

| Holdings | Quantity | Allocation | Value($) |

|---|---|---|---|

| Matic | 1.82709 | 34.37% | $2.05 |

| Ethereum | 0.00131 | 34.00% | $2.02 |

| Chainlink | 0.27983 | 31.63% | $1.88 |

| Total | 100% | $5.95 |

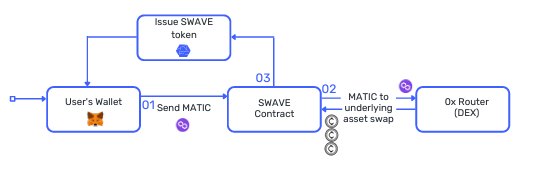

When a buy order is placed, the SWAVE app looks for the best possible quote for the underlying assets on multiple DEX. On successfully buying the underlying assets, the app mints a SWAVE token and sends it to the user. This entire process takes place as a singular transaction and increases the circulating supply of SWAVE tokens. This also ensures that the token-holder gets the most accurate price of the token at time of purchase.

The reverse happens during the sale of a token on the app. SWAVE’s underlying tokens are sold on DEX to get the best possible price for the user. At the end of the transaction, the SWAVE token is burnt.

The benefit of buying and selling the SWAVE token on the app ensures the most accurate price of your investment.

DEX like Uniswap do not work on a minting/burning mechanism. They allow one to swap a token for another at a price determined by the liquidity of the token on the exchange. The liquidity can be provided by anyone. As of March 7th, 2023, around $7,200 in liquidity exists on DEX for SWAVE.

Since the price of tokens on DEX is not determined by the NAV but is based on liquidity in the pool, the price is maintained by arbitrage activity. This price has a tendency to deviate from the NAV, especially for large orders.

To mitigate this issue, Shuts Wealth Inc. carries out some arbitrage measures to peg the price of SWAVE on DEX as close to its NAV as possible. Maintaining the price of SWAVE on DEX for larger orders is a capital-intensive task as it requires the addition of liquidity on the DEX. But doing so ensures that token buyers and sellers can get the most accurate price for SWAVE on DEX.